Google Ads Vs Google Hotel Ads: Do You Need Both?

Did you know that 2023 marks the 23rd anniversary of Google Ads? 🤯 Ad revenue now contributes 80% of Alphabet’s revenue and last year that totaled around $54 billion. Over the past 20+ years Google paid search has become an almost guaranteed budget line item for pretty much every business that is looking to advertise, reach customers, and drive revenue. Chances are, your hotel has been a loyal customer of this ad type for years. But did you know there’s a type of Google search ad that is helping hotel’s drive 5%+ of total website revenue that can’t be accessed via the standard keyword focused Google paid search campaign type?

If you’ve been a loyal Google paid search advertiser all these years and you’re not running Google Hotel Ads via metasearch advertising then you’re losing out on a very large portion of the Google hotel search ecosystem. One that could be driving a substantial amount of direct revenue for your hotel. One that the OTAs have been using to STEAL MARKET SHARE the past 10+ years.

A Brief Overview of Google Hotel Ads

Did you know the first ideation of Google Hotel Ads technically launched back in 2010? Up until 2018, hotel inventory partners running these sponsored placements had to manage them in a completely separate platform from Google Ads. When Google moved Hotel Ads into the Google Ads platform in 2018, it made it easier for advertisers to manage alongside their standard keyword based paid search campaigns. The caveat though, is that in order to run these Google Hotel Ads placements the hotel advertiser still has to rely on a Google connectivity partner to feed rates/inventory into a separate campaign type.

To clarify, just because you are running Google paid search, doesn’t mean you are live on Google Hotel Ads.

How are Google Hotel Ads Different Than Google Paid Search Ads?

There are quite a number of differences between Google Hotel Ads and Google Paid Search Ads. Understanding these differences will help you navigate between the Google search ecosystem for hotels and set your hotel up for success by best utilizing these different campaign types.

- Google Hotel Ads require a direct feed to your hotel’s (or an OTA’s) rates and inventory

Unlike Google paid search campaigns, Google Hotel Ads require a direct feed to your hotel’s rates and inventory via your CRS or booking engine. A huge factor in hotel ads campaigns quality score comes down to the accuracy of the price in your feed to the price that is shown on the booking engine landing page. Since these rates and inventory fluctuate constantly based on your inventory and revenue management, it’s a requirement by Google that there is a feed in place to keep your campaigns updated with the latest rates and inventory information. You also must use a Google technology partner that offers the ability to connect your hotel’s rates and inventory to Google Ads. This list is limited but can include booking engine/CRS companies as well as technology providers such as WIHP and Derbysoft.

- Google Hotel Ads appear in different places in Google’s search ecosystem

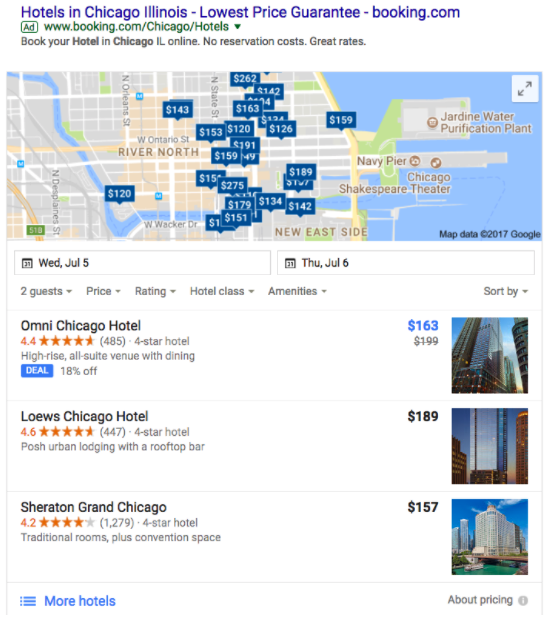

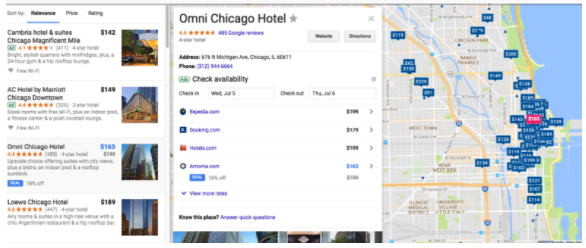

Let’s look at some examples of where Google Hotel Ads and Google Paid Search Ads appear within Google Search.

Google Hotel Ads can be found under the knowledge panel in the main search engine results page (SERP), within Google’s travel planner and within Google Maps/Local Map Packs.

Google Hotel Ads in Knowledge Panel on SERP Shown Below:

Google Hotel Ads in Google’s Travel Planner Shown Below:

Google Hotel Ads in Google Maps Shown Below:

Google Paid Search Ad placements only appear within the Google SERP at the top and sometimes bottom of the page: (unless you are opting to advertise on Google’s Search Partner Network then they can appear on a number of other sites OR if you’re participating in local search campaigns that can appear on Maps)

Google Paid Search ads in Google’s SERP Shown Below:

- Google Hotel Ads campaign types don’t use keywords for targeting

Unlike standard Paid Search campaigns, there is no keyword targeting option associated with Google Hotel Ads campaigns. You’re limited to geographic targeting, some different bid modifier options and 1st part audience targeting options.

- Google Hotel Ads campaigns can’t utilize Google’s in-market and affinity audiences

One feature that Google has enhanced within Google Ads over the years (to compete with Facebook audience targeting) is a robust list of in-market and affinity audiences. These audiences group users together that have shown intent to be in-market to purchase something (like travel to San Diego) or have an affinity (like for outdoor sports) based on their online behavior. While Google paid search campaigns allow you to target or exclude in-market, affinity and 1st party audiences (website visitors, customer database lists), Google Hotel Ads only give you the option to target/exclude your 1st party audience lists.

There are workarounds on using 3rd party data providers as audience lists but they must be imported as a 1st party audience type. Our hope is that this changes in the future but for now it’s limited.

- Google Hotel Ads has different bid modifier options

Google Hotel Ads offers bid modifications on different segments than standard paid search campaigns. Since it’s specific to hotel accommodations inventory searches bid modifiers in Google Hotel ads campaigns includes:

- Geo-Location

- Device

- Length of Stay

- Check-in day of week

- Date Type

- Advance booking window

- Audience lists

- Check-in date

Out of the above list, the only overlaps with Google Paid Search Ads are geo-location, device and audience lists

- Google Hotel Ad types contain different content

As you can tell from the screenshots in #2 above, visually Google Hotel Ads and Google Paid Search ad types contain different content. The components of a Google Hotel Ad are different than a Google Paid Search Ad.

Google Hotel Ads contain:

- Rates/Prices

- Call Outs for Marketing Messaging (via Call out Extension)

- The example below for Camelot Inn & Suites shows Family Friendly and Scooter Rentals for the official site ad and Free Cancellation for the OTA ads

- Room Type Bundles (sometimes)

- Sometimes, if Google decides and you’re in the top position they will show room type bundles with different room types/rates

Google Hotel Ad example:

Google paid search ad components that are most applicable to hotels include:

- Headlines

- Descriptions

- Display URL

- Extensions that can include

- Image (seen below)

- Sitelinks (seen below)

- Promotions

- Structured Snippets (amenities list)

- Call outs (same as seen in hotel ads)

- Location

- Call

- Lead form

Google Paid Search Ad example:

- Google Hotel Ads uses a completely different quality score rating system

Google Ads quality score is what all great account structures are built around. It is the holy grail of optimization. For keyword based Google paid search campaigns quality score is calculated based on 3 components: Expected click through rate (CTR), Ad relevance and landing page experience. Improve your scores in these three areas and the reward is lower CPCs. When you are limited on budget, it’s imperative to have it go as far as possible and by lowering CPCs and driving more clicks you’re giving your client more clicks with chances for more conversions.

Google Hotel Ads relies on different components for quality score rating. Price accuracy and price competitiveness factor into Google quality score calculation for Google hotel ads. Price accuracy comes down to making sure the rates and inventory feed from your booking engine/CRS to Google ads is as accurate as possible. If the rate shown in the ad doesn’t match the rate shown on the booking engine landing page then your price accuracy score will be negatively impacted. If Google continues to see issues with price accuracy, you risk your hotel ads campaigns being turned off. The other piece is price competitiveness. The less competitive your price is compared to OTAs, the more it will cost you for the same placements. Parity is important for all direct booking strategies but takes center stage in Google Hotel Ads.

How Can I Tell if My Hotel is using Google Hotel Ads?

Not sure if your hotel is currently using Google Hotel Ads? I recommend reaching out to your digital marketing agency or booking engine/CRS to inquire. Not all searches for your hotel will show an “official site” Google Hotel Ad, even if your hotel is currently live on Google Hotel Ads. This comes down to impression share and optimization focus. Not all impressions are created equal and you want to optimize your campaigns to prioritize impressions to those more likely to convert. You can go to your hotel’s listing in Google Travel Planner to try and view your official site ad. If you do see it, it will show with the default Google Hotel Ads green icon or preferably, your hotel’s own logo.

Should my hotel be advertising with both Google ads campaigns and Google Hotel ads campaigns?

The answer is Yes! If your hotel isn’t present on both Google Hotel Ads and Google Paid Search Ads then you’re missing out a huge opportunity to drive more direct bookings for your hotel. If you’re not advertising here, the OTAs already are and they are capturing the wealth of bookings that are driven from these campaigns. Participating with both of these campaign types also makes sure you are visible throughout the Google ecosystem where travelers are searching for hotel accommodations.

Do you have questions on how you can get started with either Google Hotel Ads or Google Paid Search Ads? Reach out to one of the GCommerce experts today for a consultation.