COVID-19 | How To Use Data To Relaunch Your Marketing Campaigns

The coronavirus pandemic has pushed us all into uncertain times and with it paused media campaigns leaving unspent marketing dollars. Now that we’re beginning to see a light at the end of a long and dark tunnel, it’s time to start prepping your hotel’s marketing campaigns with a returning strategy.

If the thought of relaunching your hotel’s marketing campaigns scares you or has you reeling on where to even start, don’t worry, you’re absolutely not alone! As experts in the digital marketing space, we’re here to guide you through this new phase and how to use data to create the best re-launch plan for your property.

Use Data to Drive Your Hotel's Marketing Decisions

At GCommerce, it’s no secret that we love data and use it as the backbone of all our marketing strategies. Whether it’s determining a monthly budget or deciding which audiences to target, your data should drive all marketing decisions. In fact, this could not be more important in the current climate given that many properties will be starting out with limited budgets, which means you’ll want your campaigns to provide as much value as possible. The big question is...where do you even start when it comes to analyzing your data?

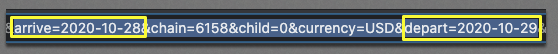

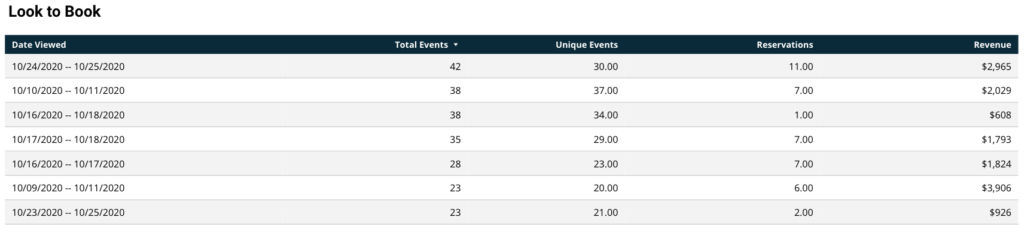

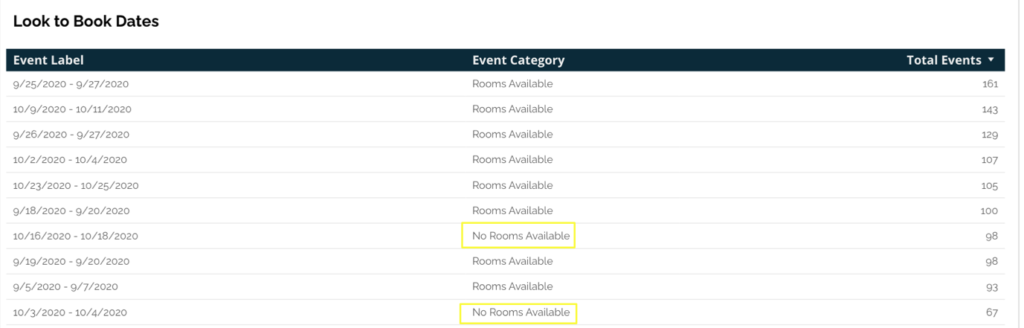

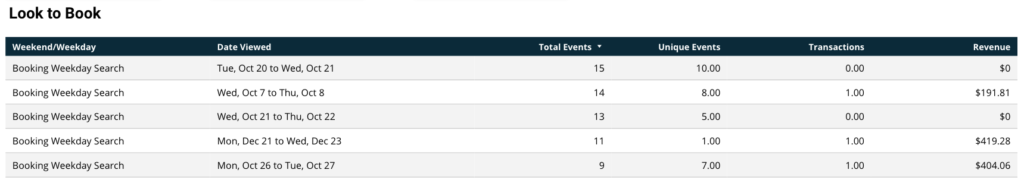

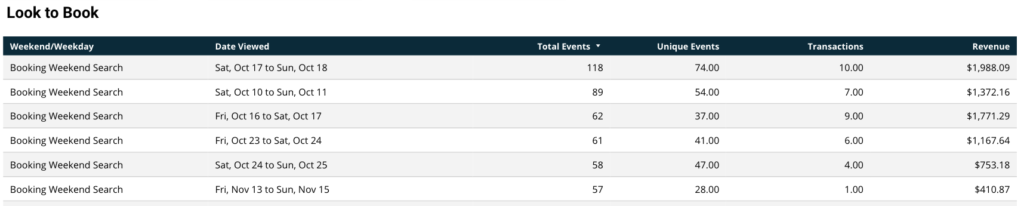

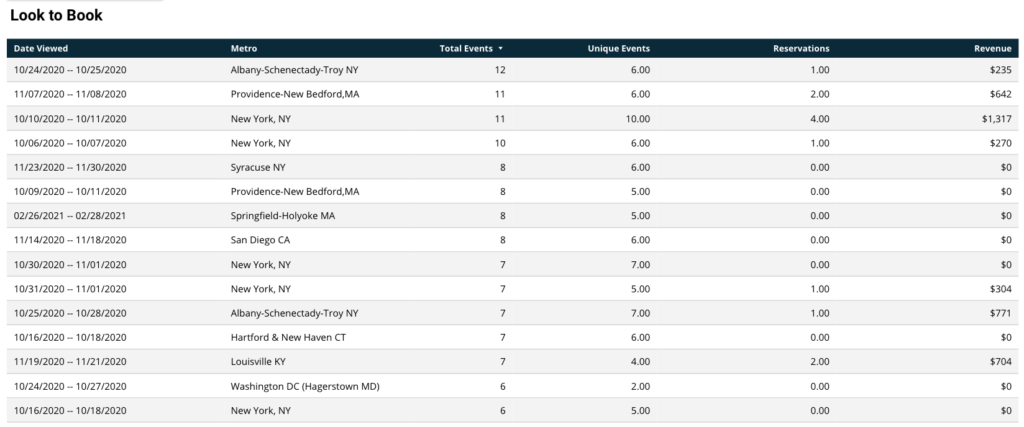

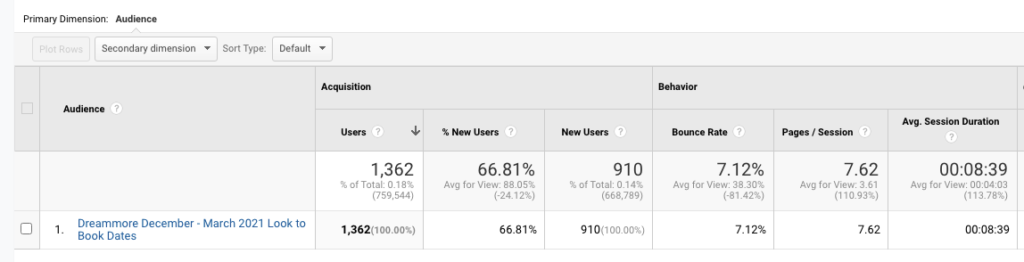

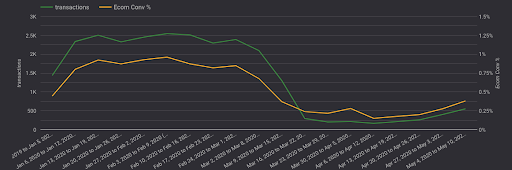

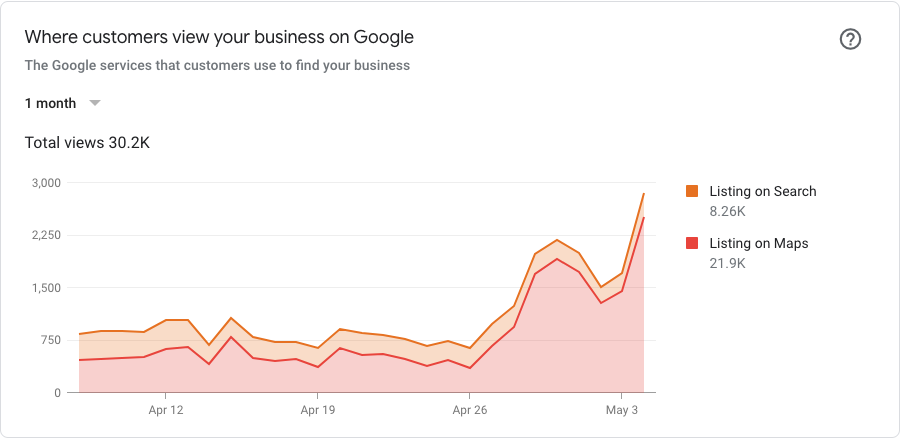

A great place to begin is by looking at your on-site data using Analytics or other direct marketing platforms. For our clients that use The Hotels Network, we’re able to monitor real-time user searches on their website and determine current user behavior. For example, we can see if users are interacting with the onsite products (pop-ups, price checks, etc.), the searcher conversion rate of your hotel versus global benchmarks, where these direct bookers are coming from, which check-in dates they are looking at, conversion rates based on lead time, and your property’s rate parity health.

Based on the available data through The Hotels Network we have a much clearer picture of how audiences are interacting with your website and if they are even ready to convert. For example, we monitor the status of one of our clients on a weekly basis. Two weeks ago we were seeing that the majority of guests were looking to travel 30-59 days out and converting at a rate of 3.10%. When we looked at data for this past week we saw a dramatic shift in that the majority of searchers were looking to book 8-14 days out with a conversion rate of 7.34% and 30-59 days out with a conversion rate of 5.70%. Even more interesting was that the next big search period was for 7 days or less and converting at a rate of 5.54%!

Using this data we could easily recommend marketing campaigns aimed at traveling and booking now and in the next month, whether it was a paid search campaign with a limited time offer or a Facebook ad welcoming guests back to the resort. We could also set up a nudge on The Hotels Network urging users looking at the selected lead times to book with special offers or risk-free reservations.

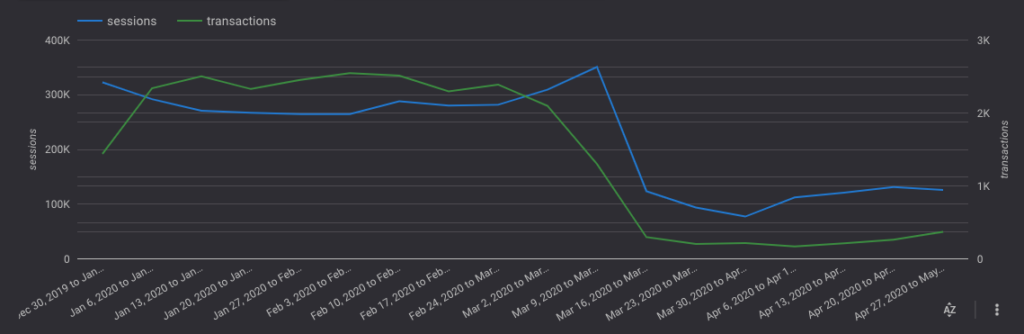

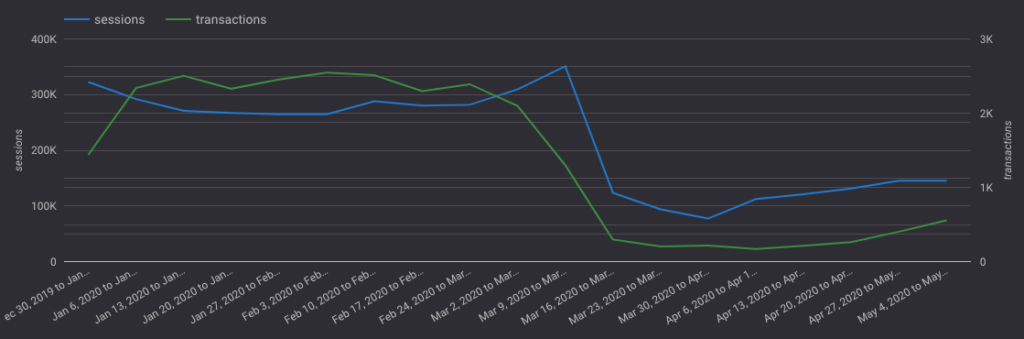

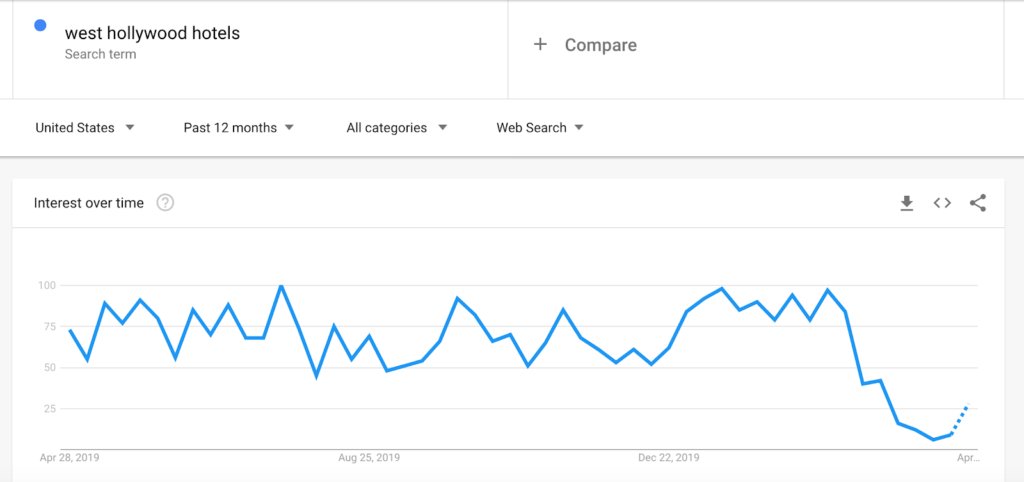

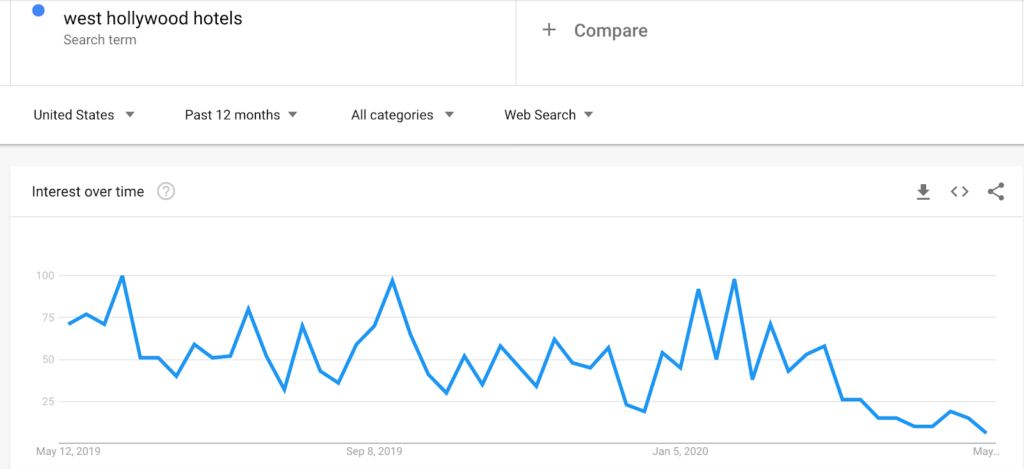

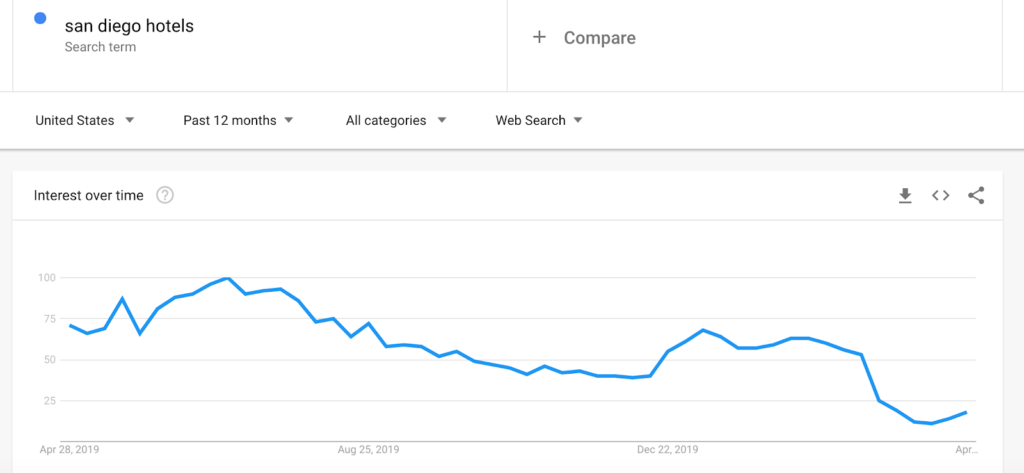

However, what if you don’t utilize The Hotels Network? Much of this data can still be found by using Google Analytics and searching through your site traffic pages, e-commerce goals, and product performance. Another great resource is the Adara Travel Trends Tracker which is updated daily. Adara is providing valuable data on flights, hotels, and other travel trends that include booking windows and travel types. These charts are a great indicator of travel as a whole.

Creating Your First Marketing Campaigns During COVID

Once you have gathered a good chunk of information, you need to figure out what types of marketing campaigns should launch first. For those limited by budget, we suggest a tiered approach to campaign creation.

1. Staycations / Local Audience

When launching your first campaign in this COVID-19 driven climate, we recommend starting local. Target your drive market with staycation offers or romantic weekends away. If you are able to open your pool or other outdoor amenities, call this out and offer your locals the chance to enjoy summer vacation even if they aren’t far from home. Even if your property isn’t hindered by travel restrictions at the moment, most people still aren’t willing to travel long distances to get away.

2. Loyal Guests/Passholders

After taking care of your local market, create campaigns targeting your loyal guests. This could be people that participate in your loyalty programs, pass holders, email subscribers, past guests, etc. This is a great audience to re-engage quickly because you know they are already familiar with your property and more willing to stay with you over other hotels or properties. On top of that, this audience is also more likely to share your brand with their friends, families, and followers.

3. Regional Guests

When travel restrictions start to fizzle out and more states begin opening up it’ll be time to start bringing in that regional audience. These are the people who will be coming from adjacent states who are looking to travel short distances. The majority of this audience will be your road tripper guests who aren’t quite ready to fly yet. You may even consider a wider radius for your drive market targeting than before, people may be willing to drive further for an escape. Make sure you consult your hotel’s data to figure out the ideal targeting.

4. Destination Guests

At the very end of this tier, we have our destination guests. These are people who will be flying in or taking long road trips and staying for more than a couple of days. Targeting these further destinations won’t really be useful until the general population is ready to start air travel again. Although this group will take longer to recover from COVID-19 impacts than other audiences, they will be key because they tend to stay longer and spend more.

How to Measure and Analyze General Campaign Metrics

Once you’ve launched your initial hotel marketing campaigns you will also need to monitor them and continually check performance. With a plethora of data to look at, it’s useful to identify key metrics to make marketing decisions. These metrics will be important to look at once campaigns have been created in order to further optimize and make sure each marketing dollar is spent wisely.

Here are a few metrics we look at consistently and how to determine the next steps.

Impressions. Impressions serve as a performance indicator at a very basic level and are great for top-of-funnel decisions. They show us a good reach estimate and help determine whether certain dimensions are worth pushing more or less budget behind. However, large impression sums don’t mean a campaign will convert well and begs the question of quality over quantity. For the current climate, we would use impressions to judge where a certain market or target audience is worth pushing budget behind or not.

Clicks. Measuring clicks is perhaps one of the greatest indicators of campaign performance, behind actual conversions. Clicks actually prove whether or not users are interested in what you are offering as a click is generally a direct action and indication of interest. If a campaign is receiving below-average clicks we know to scale back or change up the ads.

As a general rule in the marketing space, we aim for a Click Through Rate (CTR) of 1% for more easily engaging ads (Facebook) and .05% for ads that rely more on view-through conversions (Display).

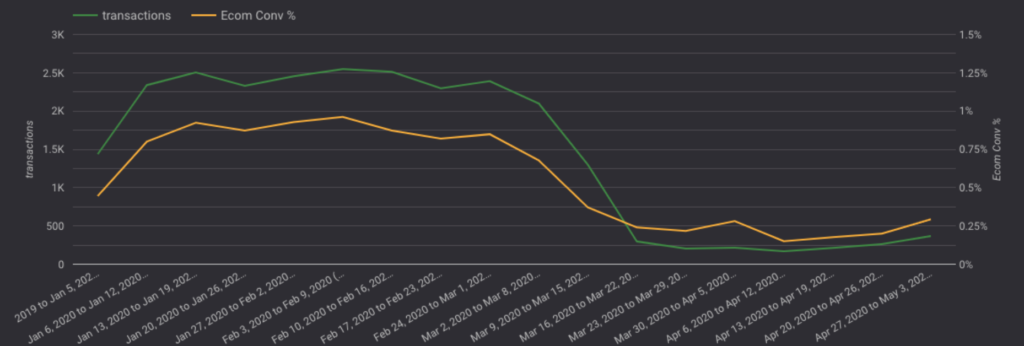

Conversions. As mentioned earlier, conversions are one of the most telling metrics. Unless you are running a brand awareness campaign, you’re most likely promoting your ad for the objective of conversions. If your marketing campaigns are displaying high numbers of bookings, that’s a great indication that you can push more budget or that you can look at expanding into different markets and interests. Low conversions at this time might tell us that your property or location is either not ready for travel or that you might be hitting maximum occupancy for the desired time frames.

Conversion Value. Getting conversions is only one piece of the puzzle. Another important metric to analyze is your conversion value. For example, high conversions with a low value could tell us a number of things. Perhaps you are offering a large discount offer, lowering your ADR, or maybe your ADR is lower than normal because of current circumstances. It could also mean that people are booking for shorter lengths of stay.

Conversion value helps complete the puzzle by giving us more insight into consumer behavior. If we see users are booking more weekend trips, we can adjust our ad copy and push more weekend offers. Similarly, if we see that conversion values are high it could mean an increase in ADR or longer lengths of stay.

It’s Time To Seize the Day

Making data-driven decisions for your hotel’s marketing campaigns doesn’t need to be hard or complicated. With warmer weather arriving across the country and a temporarily unsaturated advertising market at your fingertips, now is absolutely the time to turn your marketing campaigns back on.

Don’t hesitate to reach out to our team of hotel digital marketing experts if you’re looking for guidance with your campaigns. Contact us now.